On January 24, 2023, Goldmining Inc. (GOLD:TSX; GLDG:NYSE.American), a strategic investor in NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE), announced in a press release that it has the assay results from its drill program on the Whistler gold-copper project. The Whistler project is a majority-owned project located in Alaska, and the company reports that the results of the drilling confirm the presence of continuous mineralization on the project. Goldmining stated that the Whistler project is estimated to hold an indicated mineral resource of 3.0 million ounces of gold equivalent.

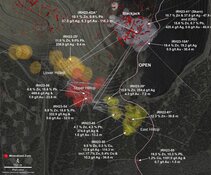

According to Goldmining, the drill holes covered a total of 2,234m on the project, and drill hole WH23-03, in particular, provided a more detailed look at mineralization in an area that had been sparsely drilled. Goldmining reports that the highlights of the drill results include 1.06 grams per tonne (g/t) gold equivalent (AuEq) across 547m intercepted by drill hole WH23-03, including 1.55 g/t AuEq across 176m, 0.60 g/t AuEq across 241m intercepted by drill hole WH23-01, including 0.74 g/t AuEq across 118m, and 0.51 g/t AuEq across 142m intercepted by drill hole WH23-02, including 1.10 g/t AuEq across 22m.

Alastair Still, the CEO of Goldmining, stated, "The success of the inaugural confirmatory drilling program by U.S. Goldmining at Whistler is another example of how our spin-out strategy has unlocked value for Goldmining shareholders."

He continued, "We now hold over CA$129 million in cash and equities, which puts us in a strong and enviable position as we look to advance strategic initiatives across the rest of our portfolio, which globally holds 12.5 million AuEq ounces of measured and indicated resources and 9.7 million AuEq ounces of inferred resources."

A Bright Year Ahead for Gold

Marin Katusa of Katusa Research reported on January 23, 2024, that the gold looks set to excel in the new year. Katusa commented, "While the world was busy elsewhere, gold quietly breached and torched its all-time high in an epic and fast run." The report states that prudent investors should look for gold prices to breach US$2,200, as that could be the catalyst for a record-breaking rally.

Earlier this month, on January 14, 2024, Egon von Greyerz with Gold Switzerland predicted that gold would have a good run this year due to a declining American dollar, which usually prompts investors to turn to commodities like precious metals. In an enthusiastic endorsement, he commented, "If you have never been a goldbug, this is the time to become one."

A Strong Buy

Goldmining Inc. has a strong strategic investment in NevGold Corp., and transferred the Nutmeg Mountain property to NevGold after finalizing an agreement for a Share Issuance Payment valued at CA$3 million.

CarbonCredits.com reviewed the company positively and stated, in an enthusiastic endorsement of the company's value, "We believe this is a value investor dream come true." The review cited the company's diverse portfolio of gold, copper, and uranium projects in highly prospective regions, such as the Athabasca Basin. It also noted the company's solid foundation of investments.

Jack Gilleland with the American Association of Individual Investors reviewed Goldmining Inc. on January 25, 2024, and noted that while the stock has demonstrated weak growth, the fundamental outlook seems positive. Gilleland noted that external factors, such as demand for safe haven investments, could push the company's stock upwards.

The company noted a number of catalysts in its investor presentation, including 79 drill holes operating on the Crucero project in Peru, several high-grade targets on the Canadian Yellowknife project, and follow-up exploration planned for the Yarumalito project in Columbia.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

GoldMining Inc. (GOLD:TSX; GLDG:NYSE.American)

Reuters provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 5.08% of the company. According to Reuters, Co-Chairman Amir Adnani owns 3.61% of the company with 6.63 million shares, CFO Patrick Obara owns 0.68% of the company with 1.24 million shares, President Paulo Valle Pereira Neto owns 0.51% of the company with 0.94 million shares, and Director Garnet Linn Dawson owns 0.28% of the company with 0.51 million shares.

Strategic Investors own 7.0% of the company, reported Reuters, as Van Eck Associates Corporations owns 4.47% of the company with 8.21 million shares, Ruffer L.L.P. owns 1.25% of the company with 2.30 million shares, Commodity Capital A.G. owns 0.54% of the company with 1.00 million shares, VanEck Asset Management B.V. owns 0.42% of the company with 0.77 million shares, D.W.S. Investment GmbH owns 0.16% of the company with 0.30 million shares, and Dr. Bost & Compagnon Vermogensberatungs owns 0.16% of the company with 0.30 million shares.

According to Reuters, there are 183.66 million shares outstanding with 174.01 million free float traded shares, while the company has a market cap of CA$156.2 million and trades in the 52-week period between CA$1.05 and CA$1.76.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp. and Goldmining Inc.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.